Economics Archives

March 17, 2018

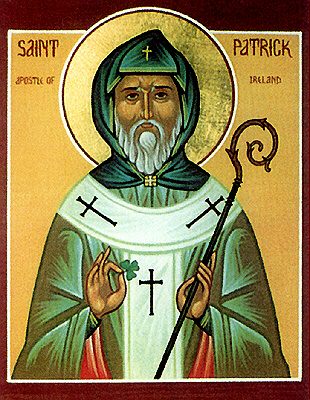

St. Patrick and the monkish wealth of nations

Despite its scientific pretensions, political economy amounts to nothing more than the integration of wealth and assets across generations. This wealth and these assets are inexorably subject to decay. They perish, and the effort of integration remains uncertain, tenuous and fraught.

Rather than emulating the complacency of the astronomer, who operates with confidence that Rigel or Polaris, while not strictly speaking eternal, nevertheless may be studied on the postulate of functional eternity, the political economist should swallow his pride and adopt instead something reminiscent of the humility of the gardener. A gardener takes nothing for granted. The caprice of the world rises foremost in his mind. A ill-timed frost carries the potential for ruin. Drought may parch the most fruitful land; flood may inundate and destroy the most careful plantings.

The introduction of hard-science pride into political economy resembles the folly of the gardener who thinks that mobile weather apps will preserve his fruits and shrubs against the elements. Agonzied exclamations — “but my phone said it would stay above freezing!”— will be answered by supreme indifference.

The astute gardener knows, however, that much depends on his enterprise. He is idle no determinist. Observation, attentiveness, well-timed exertion, cooperation, intuition, implementation of prior discoveries: by these ancient contrivances, he may meet with some success.

The astute economist, likewise, knows that the root of all wealth is human enterprise — the application of intelligence and hard work to the natural resources of the planet. Wise stewardship preserves and expands the capital stock, which arises out of the God-given fruitfulness of mankind.

There were few greater geniuses of political economy than “the great company of Irish saints” of late antiquity, whose faithful supervision of the resources available to them, in the dying anarchy of the Roman order, preserved against ruin and decay the human wealth of the ancient world. These men, among whose number we include the enigmatic and beloved saint celebrated today, give to a hackneyed modern phrase renewed life and vitality. They were the supreme wealth managers of our ancestry. No one ever applied the gardener’s humble wisdom more piously to the integration of wealth across generations, than the monks of old.

What Whittaker Chambers wrote of St. Benedict, and of his great work in southern Europe, we may also say of the Irish saints of northern Europe:

At the touch of [their] mild inspiration, the bones of a new order stirred and clothed themselves with life, drawing to itself much of what was best and most vigorous among the ruins of man and his work in the Dark Ages, and conserving and shaping its energy for that unparalleled outburst of mind and spirit in the Middle Ages.

What these saints demonstrate for us today is the narrowness of our notions of wealth, prosperity, and economy. The academic discipline which takes for its title the latter word has all but forgotten the foundation of its subject-matter: the fruitfulness of human beings, as they pass their resources, material, intellectual, spiritual, from generation to generation.

The nine-thousand-year lease enjoyed by the Irish brewer whose product many of us will joyfully imbibe today, suggests a sounder horizon for thinking about economic prosperity: not the next paycheck, not the next quarter’s evanescent earnings report, but the true wealth of nations, unto to the next age, and the age after that.

The Celtic Church, though it ultimately submitted to the authority of the Papacy, had its own character and integrity. It had never known the secular, and was largely isolated from the ecclesiastical power of Rome — a fact that became manifest when St. Columbanus came to France and quarreled with the worldly and often decadent Frankish hierarchy. We do not know precisely how these quarrels were settled, but we can reasonably guess that the settlements, which avoided what would have been a disastrous schism, were the fruit of the holiness of Columbanus and Gregory the Great, who then sat on the Chair of St. Peter.

There is a lot of contempt, in modern thought, and in modern unthinking prejudice, for the idea of monasticism. But we often forget about monasticism that it was a powerful an engine of political economy in a world where political and economic stability had vanished. In monasticism Western man found a way to be productive again; and in monasticism we see the early beginnings of that power over material forces, that stewardship of the riches of creation, that made us — the men of the West — masters of the earth. That this power has perhaps been the single most calamitously abused thing in all of the bloody history of mankind does not diminish the astonishing humility and piety at its roots. It was the piety of the simple gardener, carefully assessing the soil, patiently removing the weeds, observing, learning, submitting to forces he never imagined he could control.

And I might be forgiven for the occasional fancy that all our machines and computers and efficiency are but a slow decline from the awesome achievement that the Irish monks made visible in the gardens of the great monasteries.

So on this day when we celebrate the man who drove all the snakes from Ireland, let us also recall his Irish brethren, who so filled the world with their own “mild inspiration,” and made us who we are.

__________

Revised and expanded from older posts.